CashVision® – Smart Cash Flow and Forecasting Platform

CashVision® – AI-powered precision for end-to-end cash optimization.

Get in TouchCashVision® leverages advanced AI to forecast, optimize, and plan cash levels across ATMs, branches, and vaults—reducing costs, risks, and inefficiencies.

-

Why optimize beyond ATMs?

Because cash inefficiencies extend across branches, central vaults, and currencies. CashVision® ensures optimal allocation everywhere.

-

Why reduce cash transport complexity?

Frequent and poorly timed movements increase costs and risk. CashVision® designs optimal transport policies for secure, efficient logistics.

-

Why minimize idle cash exposure?

Excess liquidity ties up capital and raises risk. CashVision® reduces cash-on-hand while safeguarding availability.

-

Why protect compliance and reputation?

Cash operations are high-risk. Our AI strengthens compliance, reduces fraud exposure, and ensures reliable service delivery.

How it works: End-to-end intelligent cash management

Main steps

- Connect CashVision® to ATMs, branches, and vaults.

- AI models analyze historical transactions and behavioral patterns.

- Daily forecasts optimize cash levels per site and currency.

- Transport and replenishment plans are generated for secure execution.

Key Advantage

CashVision® empowers financial institutions to achieve full cash visibility and control across ATMs, branches, and vaults while significantly reducing operational costs and risks. By optimizing replenishment and transport policies, it ensures liquidity where and when it is needed—maximizing efficiency, compliance, and customer satisfaction.

- +10% increase in cash availability across all points of service.

- -40% reduction in the frequency and cost of cash transports.

- -30% decrease in idle cash, freeing liquidity for more profitable uses.

95

%Best Trade-offs found

Key Features that deliver measurable results

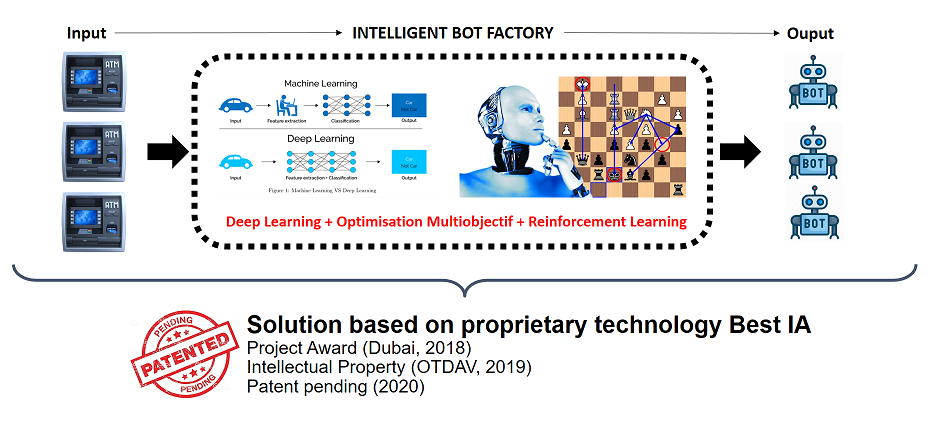

1. Advanced AI Engine

Proprietary technology uniting Deep Learning, Reinforcement Learning, and Multi-Objective Optimization for unmatched accuracy in cash planning.

2. Comprehensive Coverage

Manages cash seamlessly across ATMs, branches, central and regional vaults, and supports multiple currencies.

3. Optimized Transport Policies

Designs secure, cost-efficient cash movement strategies that reduce frequency, exposure, and operational risks.

4. Real-Time Forecasting

Provides daily, data-driven replenishment plans to minimize idle cash while ensuring uninterrupted availability.

5. Secure SaaS Platform

Cloud-based solution with banking-grade encryption and dashboards tailored for treasury, risk, and compliance oversight.

6. On-Premise Deployment Option

Flexible deployment model ensuring full data sovereignty and compliance with strict internal security policies.

Compliance Analysts’ Most Pressing Questions, Answered