Context

Despite the widespread perception in financial services that the days of cash are numbered, both the value and volume of cash continue to climb year on year throughout the developed and developing worlds. This results in the growth of charges for supporting cash circulation processes – from delivery to a bank’s depository up to withdrawing from an ATM. There is talk about a cashless society and people believe that plastic and digital forms of money are set to replace cash. But the cashless society is about as real a possibility as the paperless office, because people have a strong attachment to real money. Cash remains fundamental in our day to day global economy. The evidence shows that contrary to popular opinion, demand for cash is growing in absolute terms and relative to GDP.

ATM management is usually done by a group of individuals who have years of experience with the client and demand behaviors of the bank and who make decisions based on their judgements. The limitation that has been identified by the bank is the lack of scientific methods to make better decisions.

ATM planning and replenishment is a key service area within the retail banking environment. ATMs are client delivery channels which is a reputational risk for the bank when no cash is available. ATMs are also the only access point within the bank that clients can get their hands-on physical cash. Large volumes and amounts of monies are transferred, distributed and dispensed every day. There are a lot of costs involved within the process due to the transportation and handling of cash and on top of that there are opportunity costs associated with cash being tied up in the supply chain. Within the cash management process there are opportunities to greatly reduce the costs and to turn cash into a competitive advantage

PROBLEM

How much cash should a bank keep in an ATM daily? This seemingly simple question has significant implications. There are almost 3000 ATMs in Tunisia and more than 4 million ATMs all over the world. These must be stocked with cash. The bank must decide what is the optimum level of cash which should be maintained at each ATM daily. If the cash kept in ATM is more than the cash withdrawals by customers, it is idle cash which is not earning interest for the bank. On the other hand, if the cash in the ATM falls short of the cash withdrawals, it results in cash out leading to poor customer service and, at worst, a rumor which can spark a run on the bank.

The annual operating costs of an ATM range from € 14,000 to € 25,000 per machine, according to an article published in the newspaper Les Echos . These costs are associated with immobilized liquidity, transport, maintenance, surveillance, security, insurance and lead times.

SOLUTION

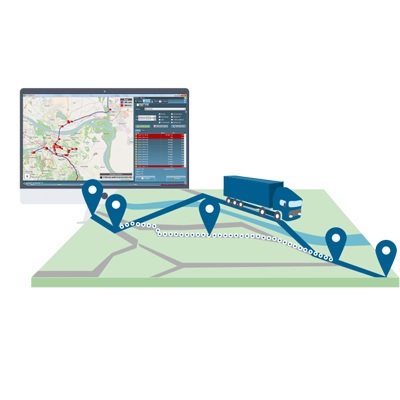

ATM CASHVISION® is an Artificial-Intelligence-powered platform that ensures cash is used efficiently throughout the ATM network of any retail/commercial bank. It was designed in close partnership with financial institutions to be at most suitable for modern banking realities and to meet banks’ demands and the best world’s practices of cash management.

BENEFITS

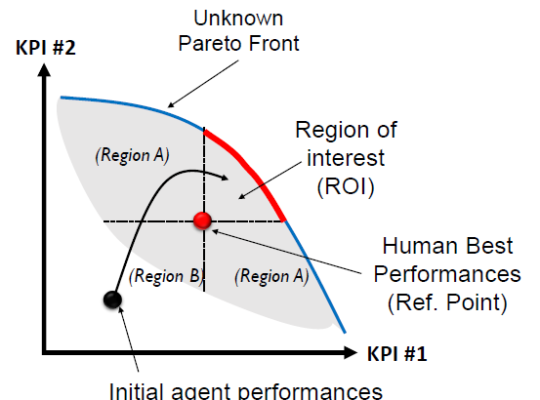

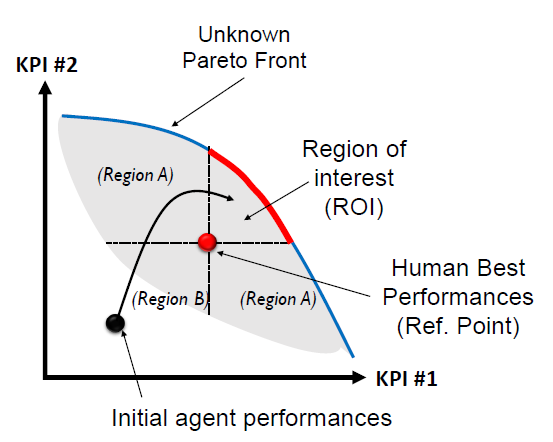

1. Optimize many KPIs at the same time!

This is one of the major challenges of decision-making! Thanks to powerful multi-objective optimization algorithms, ATM CASHVISION® makes it possible to identify the supply plans which make it possible to improve several KPIs at the same time. Being a retail bank or a cash transport company, our platform guarantees the reduction of more than 60% in the number of loadings and unloadings (cash-in and cash-out, respectively), without affecting the availability of cash in ATMs.

2. Optimizing the costs of transporting funds

ATM CASHVISION® can significantly reduce the number of routes of distributor supply vehicles, the volume and value of the cash en route, as well as the risks associated with these operations, namely theft, fraud, error counting and interruption of service during peak hours.

3. Eliminate idle cash

ATM CASHVISION® continuously learns to “decipher” the behavioral imprint of each distributor. The precision of its predictive models makes it possible to reduce the overall level of cash, and therefore eliminate the idle cash stored in excess in the drawers of ATMs.

4. Predict cash withdrawals peaks

ATM CASHVISION® is connected to a proprietary database representing variables with high correlation with customers ‘cash needs: balance periods, holidays, weather data, local special events, geolocation, crisis situations (such as COVID’ 19 and its implications).